SEMrush and competitors

SEMRush is on of leaders in SaaS Seo tools with +1 500 employees on Linkedin https://www.linkedin.com/company/semrush/ with active hiring with 53 job openings.

Partial competitor is Similarweb and it is only company from list of competitors is trading on stock exchange is Similarweb https://finance.yahoo.com/quote/SMWB

Main competitors of SEMrush are only :

-

MOZ with 310 employees on LinkedIn https://www.linkedin.com/company/moz/ with active hiring with 27 open jobs. This company was acquired by iContact Marketing Corp in 2021.

-

Ahrefs with 112 employees on Linkedin https://www.linkedin.com/company/ahrefs/ no active hiring.

-

SE Ranking with 150 employees https://www.linkedin.com/company/se-ranking/about/ , no active hiring

Small competitors

SERPstat from NetPeak marketing agency, there is no info how many people work here but I expect not more than 100 employees dedicated to SERPstat. No activel hiring. https://www.linkedin.com/company/serpstat/about/

Spyfu with 18 employees on linkedin https://www.linkedin.com/company/spyfu/ without actively hiring.

My key insights from this data and from my experience:

-

MOZ is "old-school" SEO tool and dont as much new features as Semrush and Ahrefs

-

SEMrush is fighting for dominance and TOP 1 SaaS SEO tool on the market.

-

SEMrush has all chances to run away from competitors and become "winner takes it all"

SEMrush financials

I have used quarterly SEMrush report Nov 14, 2022 for 3rd quarter of 2022 https://seekingalpha.com/filing/7067369 and i have got couple of insights https://seekingalpha.com/pr/19021080-semrush-announces-third-quarter-2022-financial-results

Key insights from SEMrush Income statement:

-

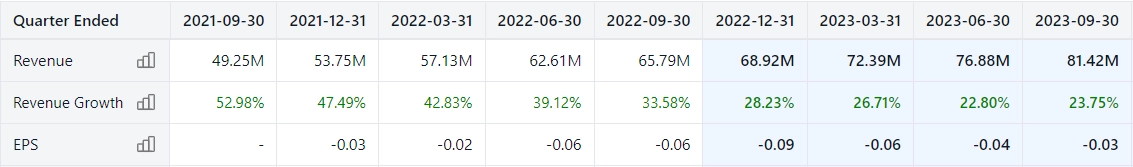

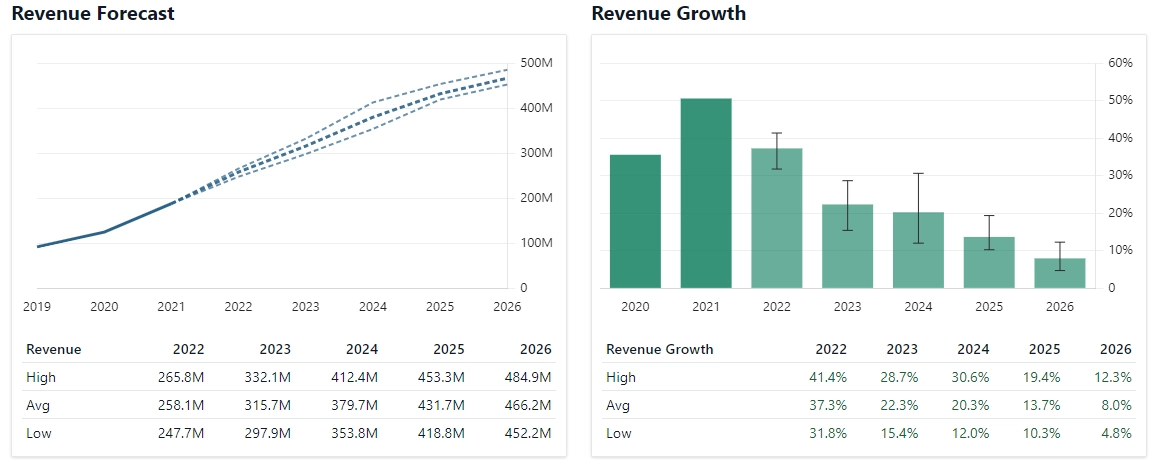

Revenue is growing with slowdown from 50% to 30% quarterly

-

Other operating expenses are one-time fees which will be 1-2M USD in 4th quarter of 2022 due to the team relocation from Russia

-

A huge increase in selling expenses and R&D teams means that the company increases its own Sales and development teams. If we investigate LinkedIn, we will see 53 Job openings

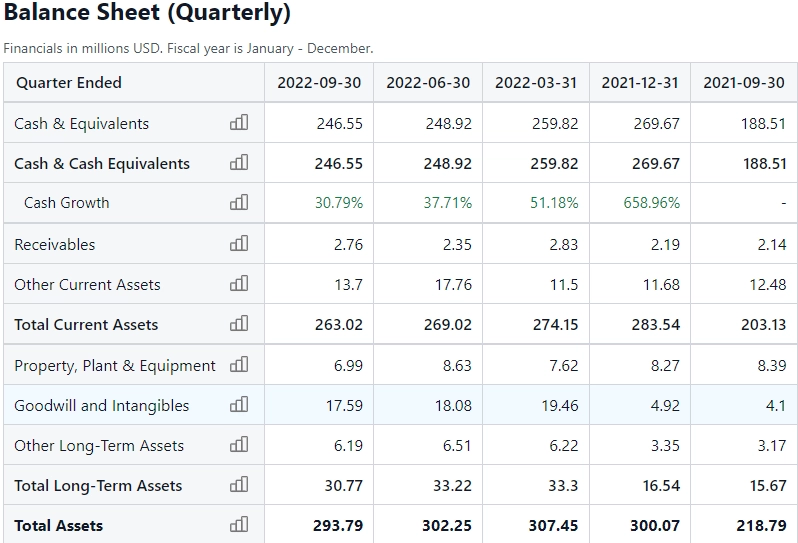

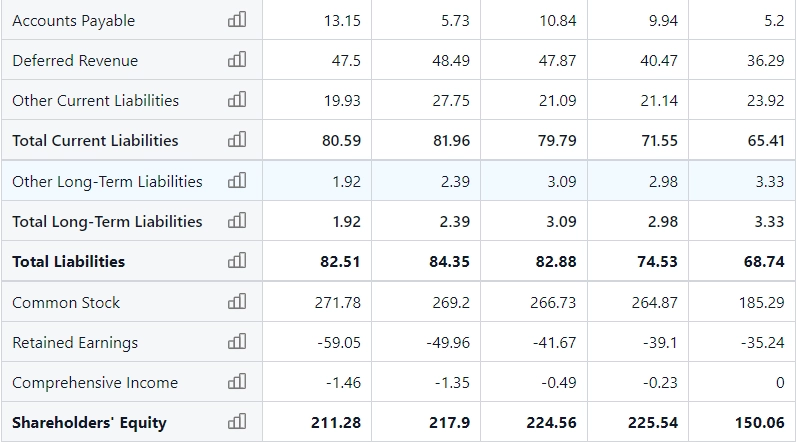

I don't see any issues in Assets, everything is OK. Cash is growing 30-50% quarterly.

-

I don't see any issues in Liabilities. You can see a very small Debt of 1.92m which has no impact into overall picture.

-

Only thing I want to mention - company issue news stocks each quarter in average 2 million, if we multiple 2m for current price 8 = it is 16m $ quarterly

Couple of insights from Cash Flow

-

This Operating Cash flow is OK for SaaS company with aggressive increase of Sales and R&D expenses

-

Capital Expenditures are small 1-3m per quarter

-

SEMRush issue new shares to get a cash almost in same amount as debt, for example SEMrush 0.6m $ got from share issuance to cover -0.52 of debt in Q3 2022.

As summary, Financials of SEMrush are quite good and I don't see any troubles here.

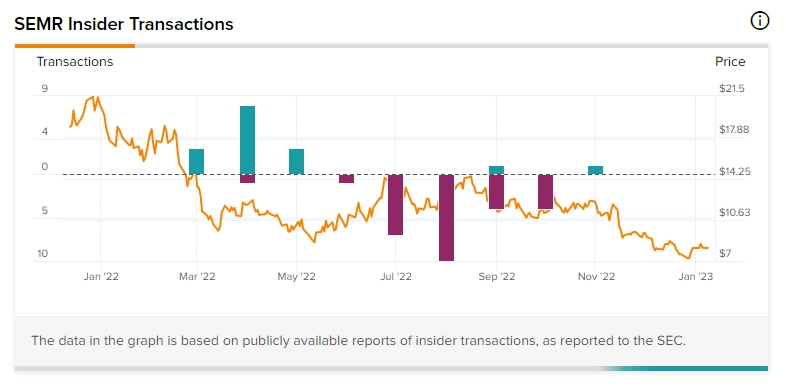

SEMrush Insider trading

Insiders was selling stocks during 2nd and 3rd quarters of 2022 and very small buying activity in November, 2022.

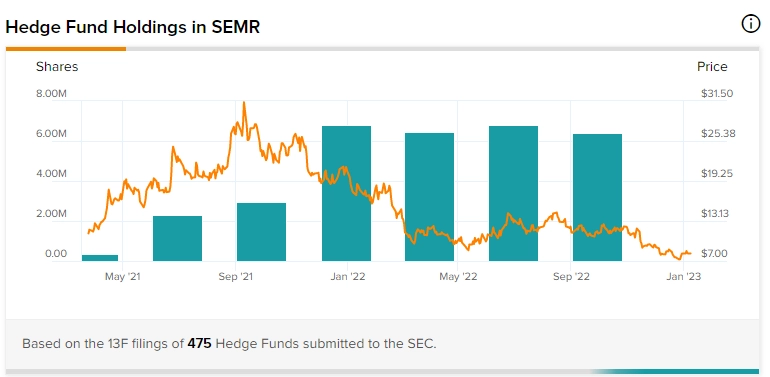

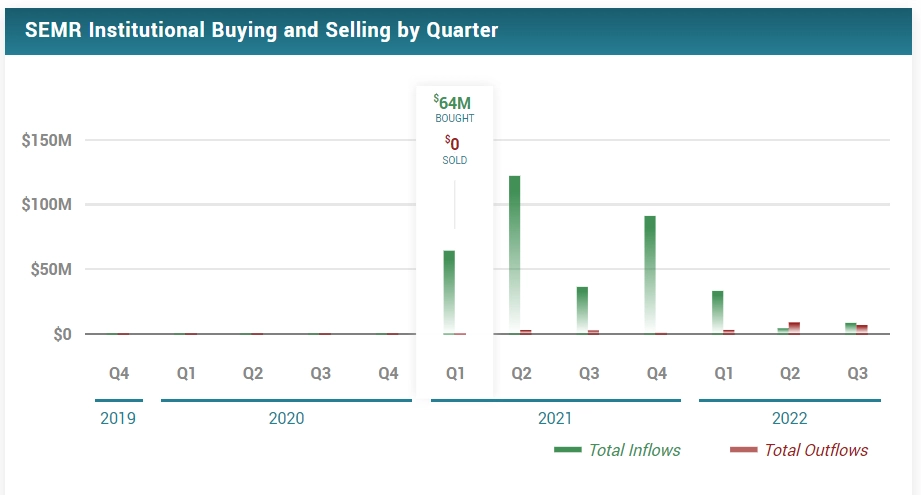

Hedge funds are still holding stocks of SEMrush and don't make selloff.

Same here from Marketbeat: hedge funds and institutions are not doing selloff.

Conclusion: insiders are waiting for positive signals to start buying, we don't see huge Buy now but we also don't see selloff as well.

SEMrush Earnings

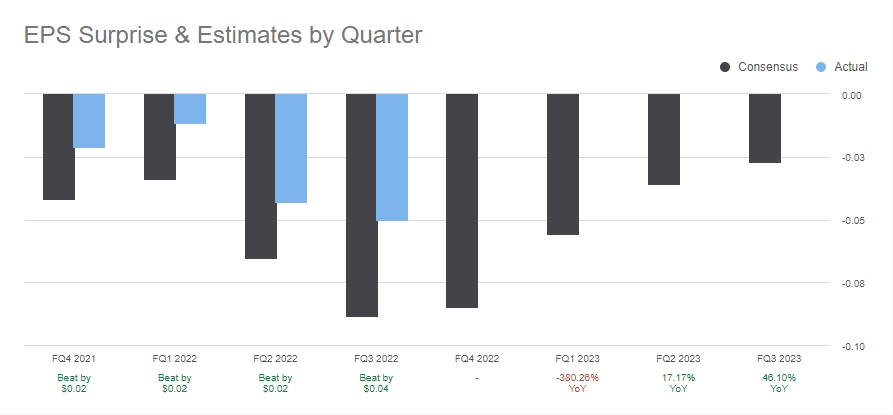

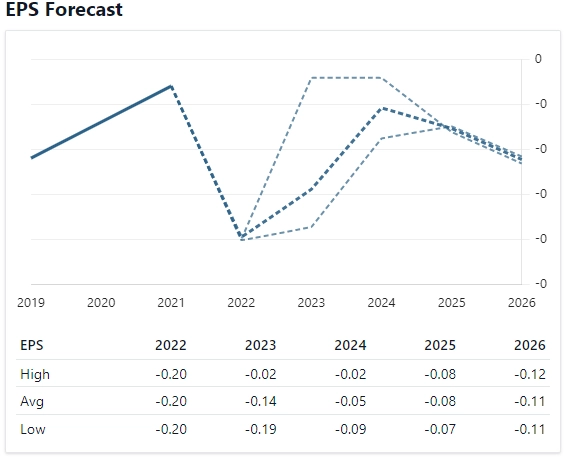

My EPS expectations are same as on picture:

-

EPS should recover and go up during all 2023 and probably 2024 years.

-

Revenue will continue to go up as company is TOP 1-2 in SaaS SEO tool

-

SEMrush will continue to increase aggressively Sales and R&D expenses to get market dominance.

SEMrush Tech analysis

As you can see, SEMrush has a strong support level close to 7.50

Summary

Here my key insights for LONG position or BUY:

-

I assume that market has alerady played on negative Net Income expectations in 4th quarter of 2022 as price went down to level 7.50

-

SEMrush is a mature SaaS company and not dependent on key clients. It means that Sales will be have sustainable growth

-

Quarterly revenue steady increase quarter by quarter at least 20-25% average

-

SEMrush is becoming TOP 1 SaaS SEO company on the market due to leadrship and huge hiring we can see evidences from LinkedIn

-

A lot of analytics expect recover in earnings per share and increase during all 2023 year

-

If you want to enter Long or BUY SEMrush between 7.50-8.00, it is quite good level to enter Long.

Sources:

https://stockanalysis.com/stocks/semr/

https://www.nasdaq.com/market-activity/stocks/semr/

https://seekingalpha.com/symbol/SEMR